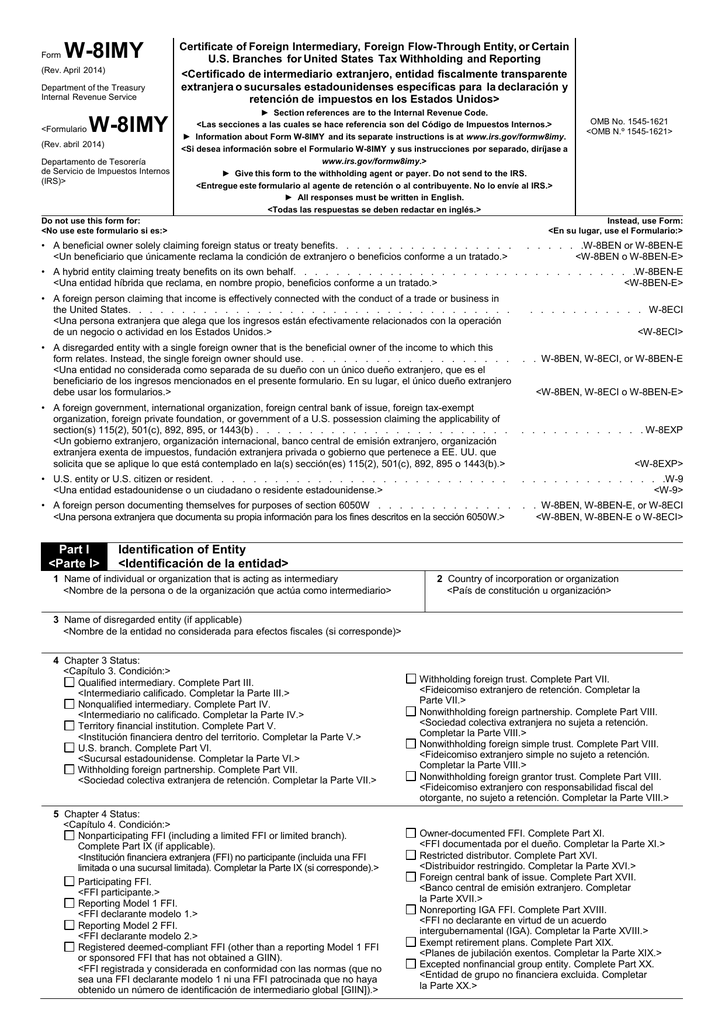

Otherwise the form will apply to all accounts. KPMG comment: A QI certifying its status under Lines 15a, 15b, 15c, 15d, or 15g should include a statement identifying the accounts for which it intends to assume primary withholding and reporting. Moved Line 15g to 15e: Former Line 15g, which addresses the assumption of withholding and reporting for substitute interest, was moved to Line 15e.Moved Line 15f to 15d: Former Line 15f, addressing a QSL that is assuming primary withholding and reporting for substitute dividend payments.Added Line 15c: Allows a QI to certify that it is acting as a nominee for Section 1446 purposes with respect to a distribution by a publicly traded partnership.Added Line 15b: Allows a QI to certify that it is assuming all withholding responsibilities for transfers of partnership interests for Section 1446(f) purposes.Line 14a: Contains the general certification of QI status, updated for Sections 1446(a) and 1446(f).Part III: Qualified Intermediary ("QI") Certifications:.Form W-8IMY) being issued in October 2021, this means that it is admissible to accept the prior forms until 30 April 2022. KPMG comment: With the current forms (excl.

#W8 imy instructions full#

TIN claiming treaty benefits for specific types of income (other than dividends and interest from stocks and debt obligations). An FTIN is required only for financial accounts maintained in the U.S. KPMG comment: The requirement to collect an account holder’s FTIN should not be relevant for Swiss FI in practice. Form W-8IMY now also includes a line to provide a FTIN, if required.

FTIN: Forms W-8BEN, W-8BEN-E and W-8ECI include a new line and checkbox to certify that a foreign tax identifying number (“FTIN”) is not legally required.The Final Regulations provide guidance on the changes expected with the new QI agreement in 2023. The current QI agreement is in effect through 2022.

#W8 imy instructions update#

KPMG comment: IRS and Treasury plan to update the Qualified Intermediary (“QI”) agreement to allow QIs to assume primary withholding obligations under Section 1446(f) as well as on distributions by publicly traded partnerships under Section 1446(a). Section 1446(f): Several updates to Forms W-8 reflect the new Section 1446(f) regime and the new reporting and withholding requirements in connection with certain transfers of interests in partnerships thereunder introduced by the Tax Cuts and Jobs Act of 2017." Instructions for Form W-8IMY," Pages 1-3.

" About Form W-8 EXP, Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting." " Instructions for Form W-8ECI," Pages 1-3. " Instructions for the Requester of Form W-9 (10/2018)." " Instructions for Form W-8BEN," Pages 1-3.Īmericans Overseas. " Instructions for Form W-8BEN-E," Pages 1-2.

0 kommentar(er)

0 kommentar(er)